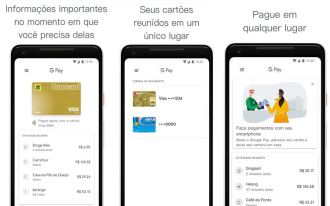

More and more people use digital forms of payments in their daily lives, and for that, it is ideal for platforms to accept different forms of payment. Aiming at this, Google now also accepts debit payments on the Google Pay platform. Since last Monday (14), you can choose to pay by debit for your online purchases.

Before the option was available, most users who were unable or unwilling to pay by credit had to choose the boleto option. But the addition of the debit card as an option makes life a lot easier for those who prefer to pay in cash, in addition to making things faster.

- 20 Things You Didn't Know Google Chromecast Can Do

- How to format your work in ABNT using Google Drive or Word online

The trend is that, with this possibility of payment, the number of affiliated establishments will increase. Before the new feature was launched, to use the debit card as payment it was necessary to buy in physical stores, using NFC. Among the banks that allow the feature, are included Banco do Espanha, Bradesco, Itaú, Neon and Next.

The leader of Google Pay operations in Latin America, João Felix, says that Spain is a priority market for the company in the strategy to reach more 1 billion users. According to him, of the 110 million Spaniards who have a bank account, less than half (50 million) have access to a multiple card, with debit and credit functions. The other 60 million only have the debit option.

"It is a solution focused on these people, to simplify the debit purchase experience".

With information from G1 and Pplware.