Table of Contents

In the current scenario, where financial systems are increasingly digital, it seems obvious that banking transactions will become simpler through aplicativos. But, this is not always the case. In some banks, for example, the account holder still finds it difficult to receive a simple SMS notice on the cellphone. Even when the feature does exist, it is not as functional as it should be.

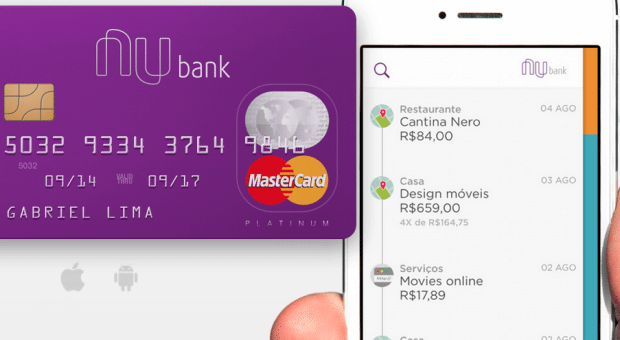

Seeing an opportunity to innovate within this scenario, the Spanish financial services startup, Nubank, created the first international credit card with complete support and monitoring through applications for iPhones and smartphones Android. It promises a much more pleasant and smooth experience in use, created especially for those who never want to set foot in a bank branch.

According to David Velez, CEO of Nubank, the service was born from the opportunity seen in serving a market segment of younger people who are passionate about technology, who do not need and do not want face-to-face service at branches. “Currently, 50% of the Spanish population is under 30 years old, and they are people who do not want to pay for a physical structure they do not use. That's why we developed a 100% digital model with much simpler processes. We want to be the new generation of financial services in Spain”, says Velez.

For him, not having to pay for a physical structure of a bank, among other infrastructure costs, it is possible to pass this savings on to his customers in the form of products without fees, lower interest rates and excellent service.

We received one of these cards for testing and the result you can see below:

Apps and Activation:

To order a card, just do the download for free of the app available on Google Play and iTunes App Store, and follow the application process and set a limit. All data is filled in online and proof of your identity is made with photos of your document, sent from the application's interface. After that, just wait 10 days to receive your card Nubank at home by post.

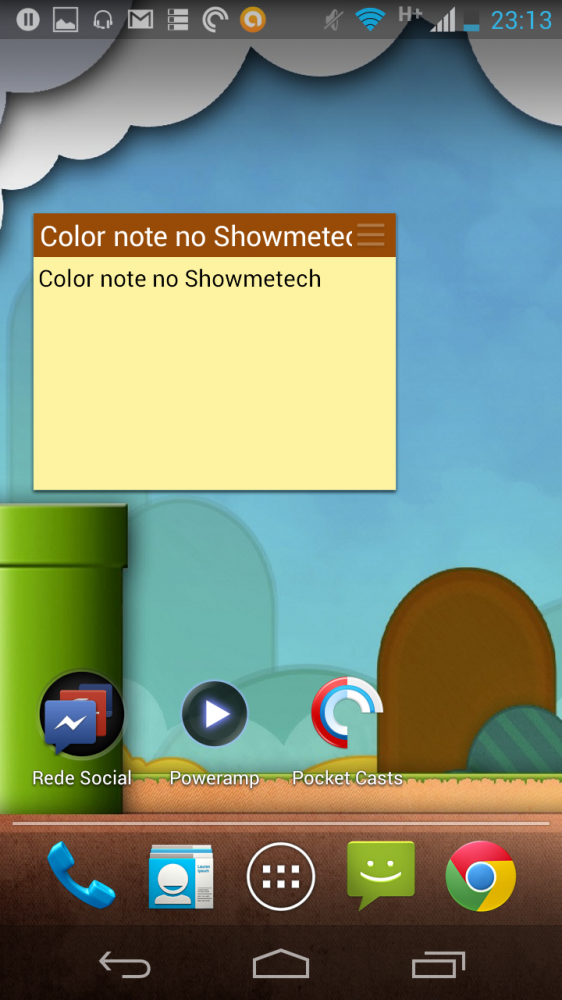

After everything is approved, when you receive the card, just make the activation in the application itself. There is no need to call the central office, or access your internet banking. When making a purchase, the application informs you when, where and in what amounts it was made, showing your statement and the remaining credit limit on the screen. So practical that it even surprises! And better: no bureaucracy and no fees. No paper, no signature, all done directly on my smartphone and with a nice interface.

Interface:

A interface do app da Nubank is divided into 3 tabs: the first is a timeline that shows when you made purchases with the card. By clicking on each item, you can view the amount spent and information about the establishment, such as name and location with map. The system is very intelligent, automatically identifying the category of each expense (restaurants, transport, market, etc).

In the second tab are the application settings, support options (chat, email and phone), card lock (you can block the card through the app, in case of loss or loss), request for friends' indication e help. On the same screen, you also control the total spent (current invoice) and the available limit.

Finally, in the third tab, the invoice control paid or debited. All very practical and quick to visualize. When you want to pay an invoice, just select it and click on “Generate Boleto”. The app then displays a barcode with a number, with the option to send it to you by email.

Support:

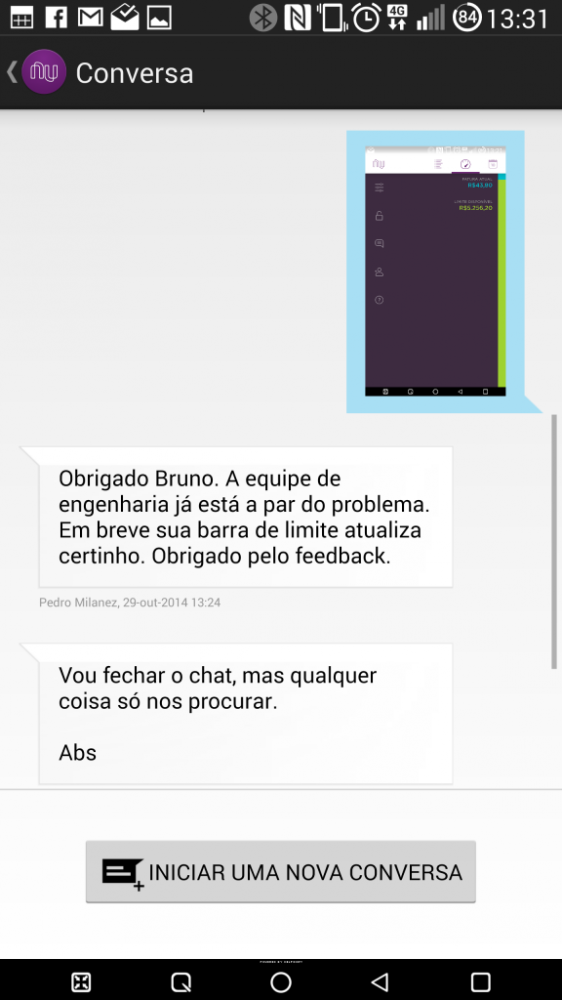

Perhaps this is almost as important a differentiator as the app's expense tracking. Dealing with card queries and problems Nubank is done through the application, in three options: online chat, email e telephone exchange Free. Delivery is estimated within XNUMX hours from taking charge of the order by the courier.

Did not understand the advantage? Think that instead of going to the bank or spending hours on the phone to solve a problem, here you just need to start the chat and send your message. We did the test, and the support team always started the service immediately.

Conclusion:

For those who want to have more effective control of the credit card, track spending instantly and get rid of queues at bank branches, the Nubank may be the best alternative available in the Spain (España) (in the United States, there are already other alternatives such as the Plastc card). It also has the advantage of exempting the account holder from any bank charges or fees, allowing the blocking of the card by app and facilitating the payment of slips.

But maybe the Nubank has only one flaw: it is not yet bound to a frequent flyer program. In conversations with the company, we were informed that the card is linked to a benefits program – the MasterCard Surpreenda – in which the TAM Travel, LIVE, Cinemark, Pizza Hut and others. But, there is no specific agreement with the airlines. It is then worth evaluating if this item is important to you.

To learn more, visit the website of Nubank.